Introduction

In an era of rapid technological advancement, online banking has become an indispensable part of our financial lives. CIT Bank, a subsidiary of CIT Group Inc., has emerged as a prominent player in the digital banking industry, providing a wide range of financial solutions to cater to the modern consumer’s needs. In this article, we’ll explore why CIT Bank stands out as an excellent choice for those seeking smart and efficient banking services.

A History of Reliability

CIT Bank’s parent company, CIT Group Inc., has a storied history in the financial sector, dating back to 1908. This long and reputable history extends to CIT Bank, which was established to provide online banking services tailored to today’s digital-savvy customers. This strong foundation of trust and reliability is one of the key reasons why CIT Bank is a top choice for many.

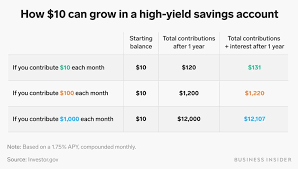

High-Yield Savings Accounts

CIT Bank’s high-yield savings accounts are designed to help customers grow their savings more rapidly. These accounts offer competitive interest rates that consistently outperform traditional brick-and-mortar banks. Savvy savers understand the value of growing their money, and CIT Bank makes it easy for them to do so.

CIT Bank’s eChecking Account

CIT Bank’s eChecking account is a game-changer in the world of digital banking. It provides customers with a seamless and hassle-free banking experience, including features such as no monthly fees, up to $30 in ATM fee reimbursements per month, and a unique cashback program. This account is designed for those who want a modern and convenient way to manage their day-to-day finances.

Certificates of Deposit (CDs)

CIT Bank offers a wide range of Certificate of Deposit (CD) options. With terms ranging from six months to five years, customers can choose a CD that best aligns with their financial goals. CIT Bank’s competitive CD rates, along with the option to ladder multiple CDs, provide flexibility and attractive returns to those who seek them.

Customer-Centric Approach

CIT Bank places a strong emphasis on customer service. They understand that, in the digital age, personal interactions are still invaluable. The bank offers a dedicated and knowledgeable customer support team ready to assist customers with any queries or concerns they may have.

Security and Transparency

Online banking necessitates a strong commitment to security and transparency. CIT Bank excels in this regard, employing robust security measures to safeguard customer information and transactions. Their transparent fee structure ensures that customers are well-informed about any costs associated with their accounts.

Mobile Banking App

CIT Bank’s mobile banking app is intuitive and user-friendly. It allows customers to manage their accounts, transfer funds, and deposit checks from the convenience of their smartphones. The app’s accessibility and functionality make it easy for customers to stay on top of their finances, anytime and anywhere.

Financial Education Resources

CIT Bank goes beyond just banking services by offering a plethora of financial education resources. Their blog and financial calculators are invaluable tools for those looking to enhance their financial literacy and make informed decisions about their money.

Conclusion

In the rapidly evolving landscape of digital banking, CIT Bank stands out as a beacon of reliability, innovation, and customer-centric service. With high-yield savings accounts, cutting-edge eChecking solutions, competitive CDs, and a strong commitment to security, transparency, and customer support, CIT Bank is indeed a smart choice for anyone seeking to optimize their financial future. Make the smart move and consider CIT Bank as your financial partner for today and beyond. Your money deserves nothing less.