In today’s fast-paced world, financial emergencies can arise at any moment. When people find themselves in need of quick cash, traditional lending institutions like banks may not always be the fastest or most convenient option. This is where Sol Crédito comes in, offering a fast, reliable, and accessible platform for microloans. This article will cover everything you need to know about Sol Crédito, from its services and offerings to how it operates and why it’s a popular choice for short-term lending.

What is Sol Crédito?

Sol Crédito is a financial technology (fintech) platform that acts as an intermediary between lenders and borrowers. It specializes in providing short-term microloans, typically in amounts ranging from €100 to €1,000. Operating primarily in Spain and Latin American countries, Sol Crédito’s goal is to make the process of securing a loan as fast and simple as possible, even for those who may not have access to traditional bank loans.

The platform is designed for individuals who need a small amount of money quickly—whether to cover unexpected expenses, medical bills, or even personal purchases. By connecting borrowers with a network of lenders, Sol Crédito ensures that customers can access multiple loan offers and select the one that best suits their needs.

How Sol Crédito Works

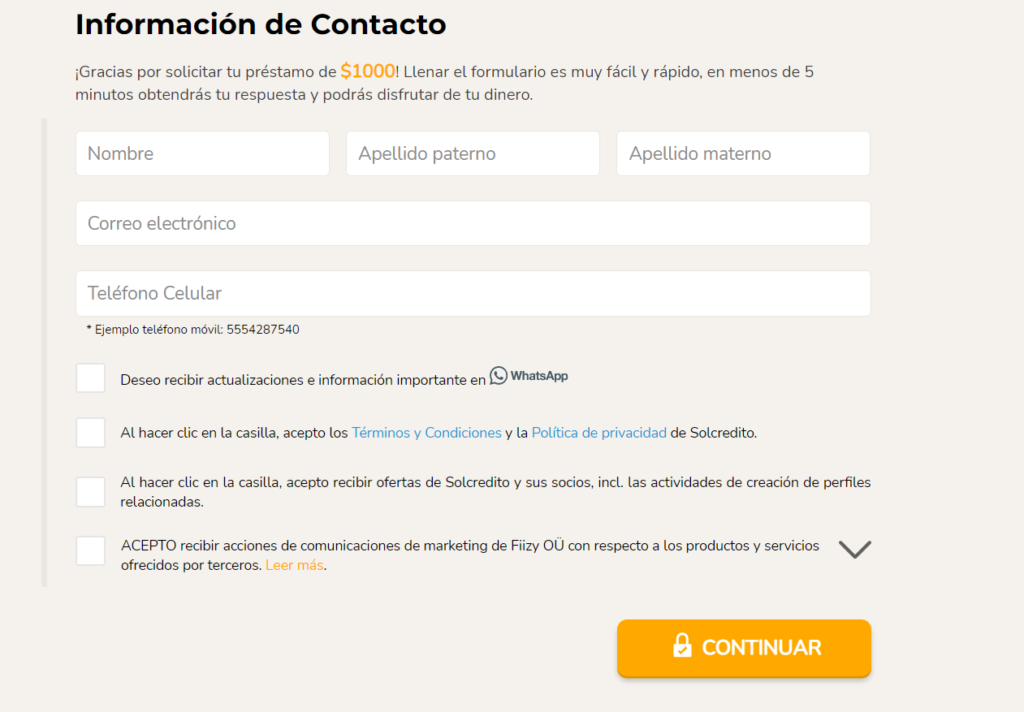

The process of getting a loan through Sol Crédito is entirely online and can be completed in a matter of minutes. Here’s a step-by-step breakdown of how it works:

1. Loan Application

Borrowers begin by visiting the Sol Crédito website, where they can fill out a simple application form. The form requires basic information, such as personal details (name, age, and ID number), employment status, and income level. The platform also allows the borrower to specify the desired loan amount and repayment period.

2. Credit Evaluation

Once the application is submitted, Sol Crédito conducts a quick credit assessment. Unlike traditional banks, which may take days or even weeks to process a loan application, Sol Crédito evaluates the borrower’s creditworthiness within minutes. The platform uses advanced algorithms and automated systems to analyze a variety of factors, including credit score, income, and financial history.

3. Loan Offers from Multiple Lenders

After the evaluation, Sol Crédito presents the borrower with several loan offers from its network of partner lenders. These offers can vary in terms of loan amount, interest rates, and repayment terms, giving borrowers the flexibility to choose the offer that best fits their situation.

4. Approval and Disbursement

Once the borrower selects a loan offer, the lender processes the request. If approved, the funds are transferred directly to the borrower’s bank account, often within 24 hours, though in many cases, the transfer can happen even faster.

5. Repayment

The repayment terms vary based on the lender and the loan type, but borrowers can usually choose between short repayment periods (as short as 7 days) or longer terms (up to 90 days or more). Payments are typically made via bank transfer or direct debit, and some lenders may offer flexible payment schedules depending on the borrower’s financial situation.

Key Features and Benefits of Sol Crédito

Sol Crédito has positioned itself as a leading microloan platform thanks to several notable features:

1. Speed and Convenience

The platform’s streamlined application process allows users to secure funds quickly, often on the same day they apply. This is particularly beneficial for people who need immediate cash to cover emergency expenses.

2. No Need for Physical Documents

Unlike traditional banks that require in-person visits and physical documentation, Sol Crédito’s entire loan process is online. This eliminates the hassle of paperwork, making it accessible to users with a smartphone or computer.

3. No Collateral Required

Sol Crédito specializes in unsecured microloans, meaning borrowers don’t have to provide any form of collateral (such as property or valuable assets) to obtain a loan. This is ideal for individuals who may not have collateral to offer or who do not want to risk losing their assets.

4. Flexible Loan Terms

One of the main advantages of Sol Crédito is the flexibility it offers. Borrowers can select the loan amount, repayment period, and lender that best suits their needs. Whether you need a loan for a few days or several months, there are options to accommodate different situations.

5. Wide Network of Lenders

Sol Crédito’s large network of lending partners ensures that borrowers are not limited to one option. By providing multiple offers, the platform encourages competition among lenders, potentially leading to better loan terms, lower interest rates, and more favorable repayment conditions.

6. Accessible for Various Financial Profiles

Sol Crédito caters to a wide range of borrowers, including those with less-than-perfect credit scores. While the platform still performs a credit check, its criteria may be more lenient than those of traditional banks, making it an option for individuals who may have been turned down elsewhere.

Interest Rates and Fees

As with any loan platform, it’s important to understand the costs associated with borrowing through Sol Crédito. Interest rates for microloans can vary significantly depending on the lender, the borrower’s creditworthiness, and the loan terms. Since these are short-term loans, the interest rates are typically higher than those for long-term loans offered by traditional financial institutions.

For instance, annual percentage rates (APRs) can range from 20% to over 1,000%, depending on the duration of the loan and the lender. It’s crucial for borrowers to carefully review the terms and understand the total cost of the loan before committing.

Additionally, Sol Crédito may charge service fees for facilitating the loan. These fees are generally transparent and included in the overall cost of borrowing, so there are no hidden surprises.

Eligibility Requirements

While Sol Crédito aims to be accessible, there are still some basic eligibility requirements borrowers must meet:

- Age: Borrowers must be at least 18 years old.

- Residency: Borrowers must be a legal resident of the country where Sol Crédito operates (primarily Spain and some Latin American countries).

- Bank Account: A valid bank account is required to receive the loan and make repayments.

- Income: While there is no fixed minimum income requirement, borrowers must demonstrate a reliable source of income to repay the loan.

- Credit Check: A credit check is usually conducted, but Sol Crédito tends to have more lenient requirements compared to traditional banks.

Why Sol Crédito is Popular

Sol Crédito has gained popularity for several reasons:

- Fast Access to Funds: In urgent situations, speed is critical. Sol Crédito provides one of the fastest loan approval and disbursement processes available online.

- Transparent Process: Borrowers are presented with all the necessary information upfront, including loan terms, interest rates, and fees, ensuring transparency.

- No Long-Term Commitments: Since these are short-term loans, borrowers can quickly repay the loan without being tied to long-term debt.

- Inclusive for Different Credit Profiles: Sol Crédito welcomes borrowers who may not have a perfect credit history, making it more inclusive than many traditional lenders.

Potential Drawbacks

Despite its many advantages, there are some downsides to using Sol Crédito:

- High Interest Rates: Short-term microloans can come with very high interest rates, which may not be ideal for borrowers who need long-term financial solutions.

- Short Repayment Periods: The short repayment terms may be difficult for some borrowers to meet, especially if their financial situation does not improve quickly.

Final Thoughts

Sol Crédito offers a fast, convenient, and accessible solution for individuals in need of small loans. By simplifying the loan application process and providing access to a wide range of lenders, it has become a go-to option for those seeking short-term financial assistance. However, due to the high interest rates associated with microloans, it’s important for borrowers to use the platform responsibly and ensure they can meet the repayment terms.

Overall, Sol Crédito is an excellent resource for people looking to bridge financial gaps quickly, but as with any loan, understanding the terms and potential costs is essential before committing.